LACDT provides the potential to significantly reduce the SCR by taking into account the tax relief arising out of the future losses under the SCR stresses. Given this is an area of potentially immense complexity and requires a number of expert judgements, we have written this briefing note to cover how (re)insurance firms can maximise the benefit of capital relief through LACDT.

This paper covers a number of areas including how LACDT is calculated under the Solvency II regulations, how firms can justify an allowance for LACDT, the modelling of future taxable profits, the practical challenges in recognition of LACDT, amongst others.

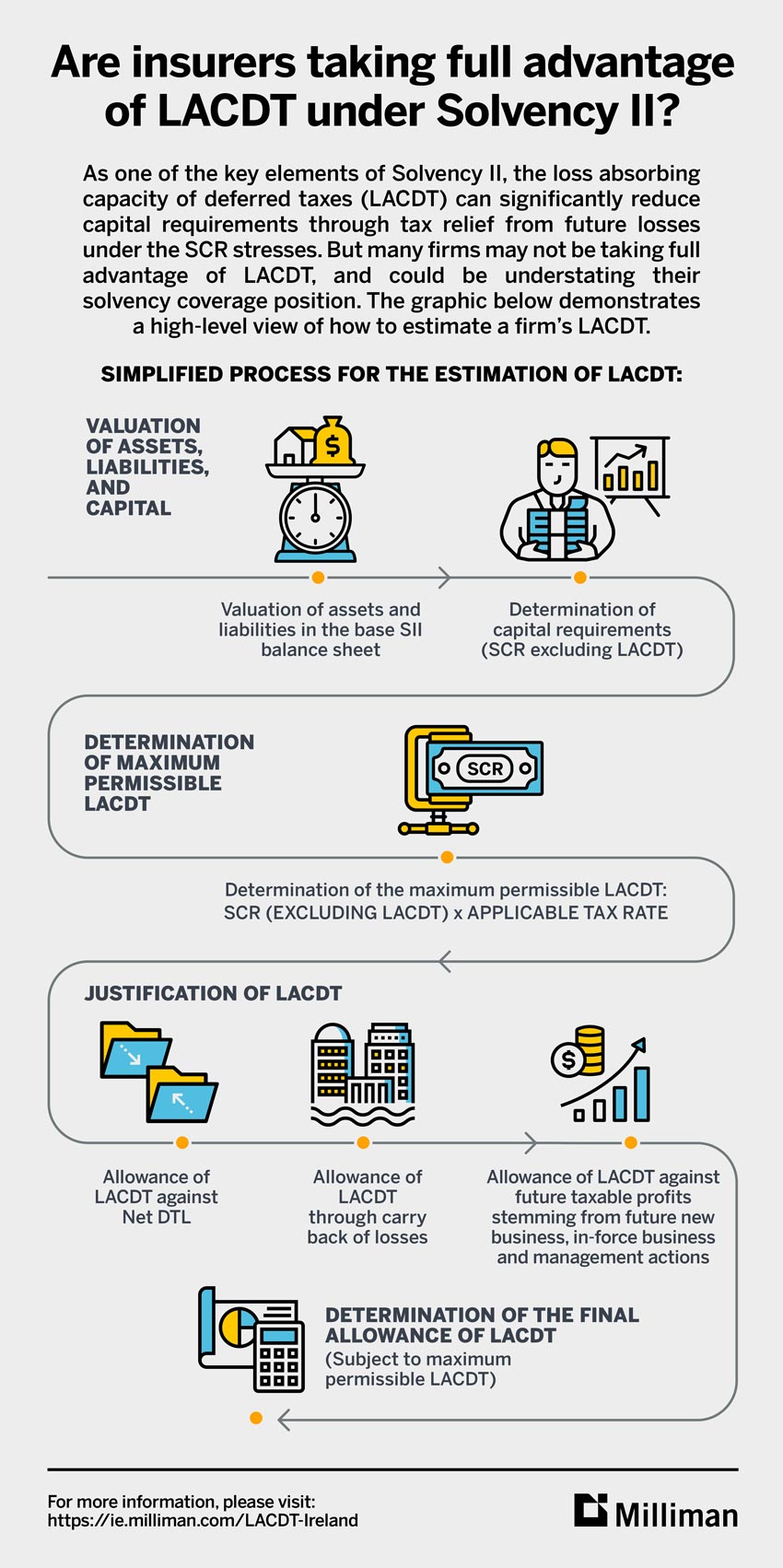

Below is an infographic that demonstrates a high-level view of how to estimate a firm’s loss absorbing capacity of deferred taxes (LACDT)