South Africa's robust insurance sector presently includes some 140 licensed carriers, offering everything from ZAR 1,000 sum assured funeral policies and cell phone insurance to sophisticated structured products with guarantees and cell captive structure for large industrial companies. But that is not the whole story in a region with many social and economic complexities. Besides these licensed insurers, several smaller, less formally structured and unlicensed entities also exist, providing coverage almost incidentally to their core business of providing funerals or community savings initiatives called “stokvels”.

With formal microinsurance legislation within sight for 2016 after many years of nearly imperceptible progress, the environment of these unregulated microinsurers is about to become more complicated as regulators look to enforce insurance laws even more stringently now that an appropriate legal framework is available.

Microinsurance, as envisaged in the South African Micro Insurance Policy Framework, is less “micro” than it is in other sub-Saharan African countries. With maximum sums assured of ZAR 50,000 for life insurance risks and up to ZAR 100,000 for protection of property, established, regulated insurers will also eye the benefits of simpler capital requirements, somewhat relaxed market conduct constraints and the promise of lower operating costs. The capital requirements are likely to be lower for many small- and medium-sized insurers than the new Solvency Assessment and Management (SAM) regime still expected to be in place in the second half of 2016.

The hope is also that the lightweight alternative to complex SAM requirements will attract new entrants into the funeral insurance space, promoting competition and driving down persistently high premiums.

Not surprisingly, some of the changes that are expected to come with the new laws raise concerns among the smaller companies, which tend to operate with limited governance structures, intuitive pricing and no formal risk management. They are vulnerable to financial requirements that may undermine their current operating models. Often, the size of the management teams and/or boards of directors in these companies is limited—new regulatory requirements could well spell the difference between life and death for some of them.

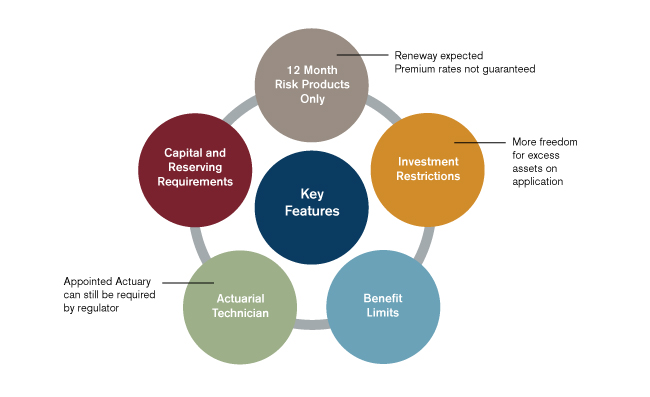

Figure 1: Microinsurance in South Africa

What happens when the actuary is aware of issues outside of scope?

The question of actuarial professional ethics in situations where responsibilities are narrowly defined can work to the advantage of smaller companies such as microinsurers, where actuaries must make formal choices about the following actions when they become aware of critical issues outside of the scope of their responsibility.

- Ensure that all factual information and analysis necessary is included in scope

- Raise attention of committees and board

- Raise issues of risk/solvency/conduct where nobody is looking at them

- Seek additional professional support

Another issue to consider: If it is not the responsibility of the actuary to look out for the policyholder, then whose responsibility is it?

Because of their smaller sizes, microinsurers often find difficulties with governance issues, which require a degree of vigilance they may not have the formal resources for on staff. This is another responsibility that falls naturally to actuaries—certainly they are in positions to identify and help correct many of the sources of these problems. In terms of reporting, actuaries can help bring a degree of rigor that may be useful for its cost-effectiveness in terms of maximising the skill set offered—and needed. In terms of steering the microinsurance ship, actuaries can proactively help to foresee and find ways to ameliorate problems of solvency, governance, risk and other issues that increasingly confront boards of directors and management teams in small organisations such as microinsurers.

One expectation, for example, is that professional actuaries will be required to determine premium rates on microinsurance products. While this could indeed mean additional expenses for the small companies, there is a bigger picture worth considering: the skill set of professional actuaries is not limited to pricing, but extends naturally into such critical areas as reserving, solvency and reinsurance. An actuary on staff can help backstop some of the key responsibilities in those areas now falling to stretched thin management teams and boards, which may not have the skills to execute them efficiently.

Today, many actuaries are already involved in microinsurance initiatives in Africa. They are making valuable and cost-effective contributions in helping to assess renewal expectations and in analysing premium rates and the demographic profiles of collectively priced groups. Actuaries can assess capital and liquidity needs in recommending expansion of investment mandates for companies of all sizes. Advanced modelling of concentration risks and the demographics of a portfolio can guide risk measures with which management can engage in making their decisions.

In South Africa, an appointed Actuarial Technician will be required by regulators to sign off on premium rates. What's interesting to the professional actuary is how narrowly defined the role tends to be—the actuary signs off on the premium rates, but is given no responsibility for reserves, for capital requirements or for solvency. The potential areas of ambiguity are easily imagined. If, in the analysis of the pricing, an actuary comes to understand that the reserves are too low, for example, it is nevertheless technically not the responsibility of that actuary to bring that to anyone's attention. Yet clearly it is irresponsible on some level to say nothing of it to the board of directors, which ultimately must bear the responsibility.

For actuaries, this has even become something of an issue of professional ethics. What is the role of the actuary whose responsibilities do not extend to issues on which that person is skilled and informed? Actuaries are still sorting that out (see sidebar, "What happens when the actuary is aware of issues outside of scope?"). The view that seems to be winning favor for now argues it is irresponsible for actuaries to remain silent when they are aware of issues that may threaten the life of a company, even though the actuary may have no explicit responsibility in the critical areas.

The solution for microinsurance entities thus appears even clearer on that basis. Hire an actuary—not just for the premium pricing, which is likely to become an even more widespread regulatory requirement, but also for all the skills that an actuary can bring to the boardroom. Actuaries have a history of taking responsibility for hundreds of years on issues related to solvency and to the prudential management of insurers as well as advocating for policyholder interests. The roles come naturally to the actuarial profession at this point.

Yet even as much of this is well-known conventional wisdom now, there is a more pressing question of how much an actuary can offer within the narrower and limited environments of microinsurance. In both developed and emerging markets, regulations continue to evolve. In some parts of Africa, the role of the actuary as central to the prudential management of insurers is still growing and actuarial roles are at best narrowly defined, as is the case with microinsurance in South Africa.

Many times actuarial responsibilities are only vaguely defined or indeed not defined at all. In addition, an actuary must consider whether some responsibilities are "understood" or "implied" because they already explicitly apply in some sectors of South Africa or more generally in the world. At the same time, there is a pronounced trend in South Africa toward making boards of directors more explicitly responsible for these issues. For these reasons, actuaries need to be mindful of their part in all shared responsibilities.

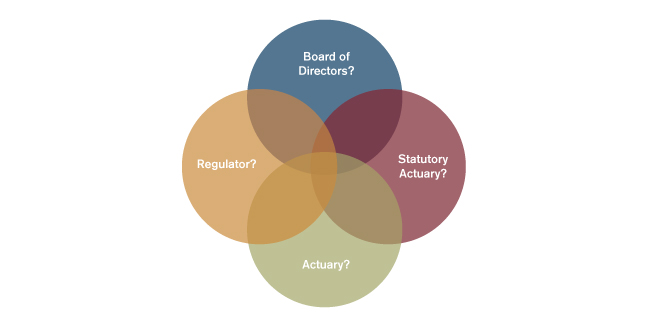

Figure 2: Failure of Insurers: Who Is to Blame?

For microinsurance companies, it's arguable that—counter to the intentions of the regulations—the responsibility of actuaries is greater than that for actuaries within larger insurers. Larger insurers will typically have greater depth of skills and insurance experience with less reliance placed on an individual’s assessment of risks. Given the need for an actuary with an understanding of the business, the policyholders and the risks, it may actually be cost-effective for microinsurers to rely on actuaries for additional responsibilities where they can make use of their insurance expertise more widely. An actuarial consultant such as Milliman can bring a great deal of backstopping knowledge and experience to bear on the problems facing the microinsurance field, which itself can be such a vital component to many developing economies.